So one of my most promising endeavors remains discretionary trading during times of great volatility – that is – just after reports. During these times, price action remains king, but it is usually dominated by momentum where applicable. I have found that the three major report types I follow do have their own “character.” What follows are some thoughts – some things I look for in each type of report.

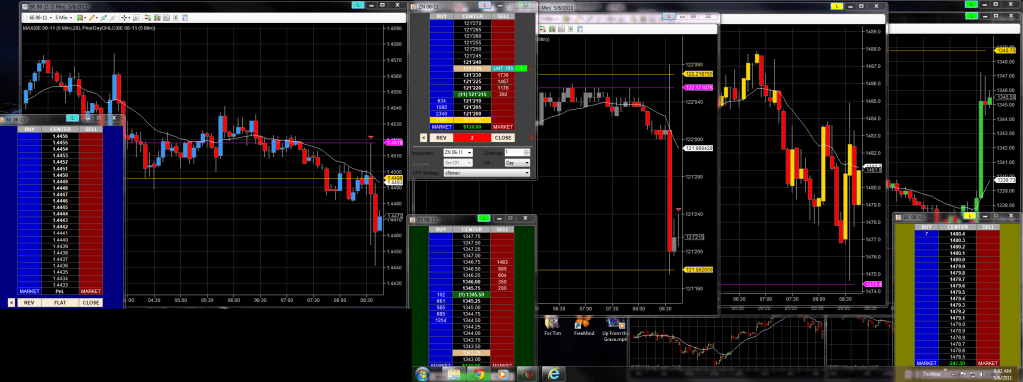

1. Unemployment Report, usually 8:30 AM on the first Friday of every month. These reports generally cause more volatility in Gold, the Euro, and Treasuries than in the S&P futures, but the S&P’s can still have a good run at these times. Overall, I think that the Treasuries are the most directional in these reports, followed by the Euro and then Gold. When the S&P’s are moving, I would slot them between the Euro and Gold. For all four markets, I think it is generally good advice to wait for the first five-minute bar to form before directional trading, though I have had good experience with volatility trading in the Euro and Gold during the first few seconds and minutes. Very often, the Treasuries will have a strong directional move, and following it is simply a matter of building a position in that direction, preferably on pullbacks. Despite being the second most directional in my opinion, I think the Euro has been fairly tricky at times. It is not as easy to follow as the Treasuries, and will often “chop around” without going very far. Be very careful chasing the Euro too early – it is pretty common to see it snap back to the original area before either continuing in that direction or just going nowhere. Waiting for this “snap back,” I think, is a sound strategy. Trades in the Euro that combine directionality with volatility exploitation are best, but the Euro will often have the longest-lasting trends of the bunch. The first H1/L1 and H2/L2 after a trend are generally reliable, as are trades near the EMA. Gold has probably been my favorite market at these times, despite its reduced sense of direction. For me, Gold seems to have the optimal mix of volatility and trending, such that it offers many opportunities to capitalize on both aspects. When the S&P’s do move, my approach is very similar to that of the Treasuries. Perhaps I should say that my approach to Treasuries is that they are less-liquid S&P’s, but with stronger trending.

2. 10:00 reports that cause moves. I have followed these in the S&P the most, and I have found these to be reliable momentum plays. However, there is a higher risk of a reversal than that present in the unemployment reports. The other three markets will rarely develop their own trends based on this report, but if they do they can be traded in the manner above. Gold is usually volatile around this time anyway, and if the Euro has some movement, usually you can have some decent price action setups utilizing both trend and volatility. The EMA in both markets tends to be pretty valuable here. I think the Treasuries are the least likely to start a trend in this fashion around this time, but if they clearly do, it should be a pretty easy train to ride.

3. FOMC reports. These are my favorite reports in the S&P, and I will say that FOMC reports differ quite a bit from the price action of “regular” reports. Many have commented on the “three-leg” pattern prevalent on many FOMC charts, and while I wouldn’t necessarily look to count legs real-time, you will very likely see about two major reversals on an FOMC chart. I would say that a strong S&P trend in one direction for the rest of the day is very unlikely, but if it does happen it will likely not be a noisy report. During these reports the S&P trends the least but has the best price action. Many signals are more reliable and quite easy to read. Volatility plays set up nicely, and the market usually respects an average daily range.