So, it’s been almost one year since my last update on this small blog. This blog began as a means of keeping interest parties informed on my daily analyses of the S&P futures market. My primary mode of analysis has been price action, and though there may be thousands of individual approaches that qualify as “price action methods,” I have used numerous examples to attempt to illustrate the way I have been going about it. You can see some terms and abbreviations used in these charts here. In this post and the posts that follow, I will review my approach thus far, how it has changed in light of my new job situation as of January of 2011, and how my thoughts and aims have evolved independent of availability concerns.

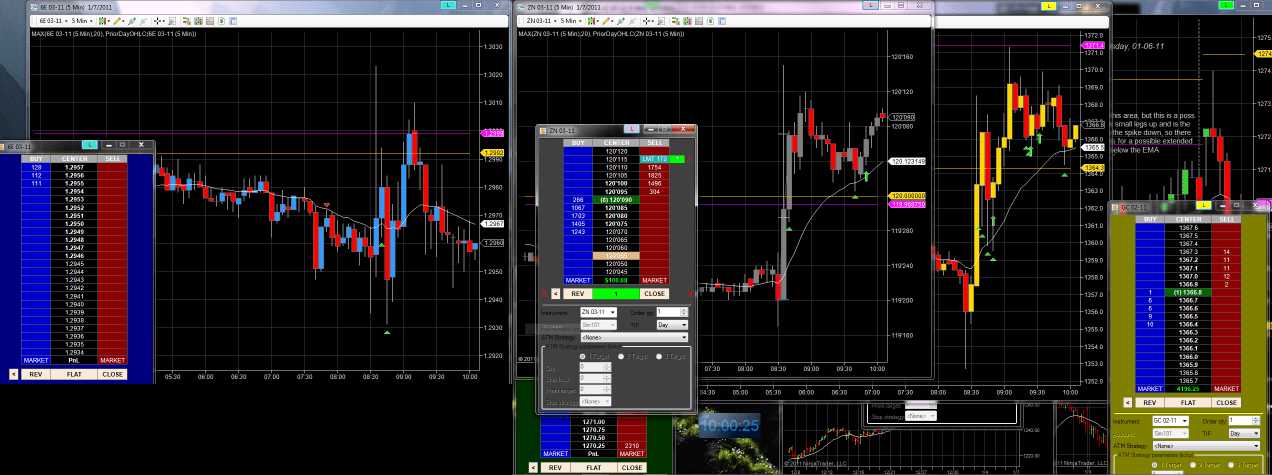

This blog has covered my analysis of the S&P, but my efforts had been expanding even during the time covered by the blog. On a few occasions I have mentioned setups in gold, the Euro, and T-notes, applying price action techniques to these other markets. In theory, price action “works” in almost any market with enough liquidity and a small-enough tick size to be trade-able, but I do think different markets have their own “personalities,” so to speak. When I first started, I was of the opinion that it was better to specialize in one market to become fluent with all of its “idiosyncrasies.” But I have since relaxed that prescription and consider the Euro, gold, T-notes, and the S&P with about equal weight in my short-term discretionary efforts. And over time, I feel that I have become familiar enough with each market’s tendencies to capitalize on opportunities in each.

That being said, I have also had a strong interest in algorithmic strategies since the beginning of my trading development. I have cycled through several platforms, from trials with Trade Navigator and MetaStock to an extensive time with TradeStation and most recently NinjaTrader. In truth, algorithmic trading is much less about the “perfect system” and much more about diversification, dynamic optimization (note that NinjaTrader supports “walk-forward” optimization), and disciplined money management. Of course you need an edge, but that alone is not enough.

These two approaches have been very distinct areas of study for some time, but my new job situation as of January of this year has changed my availability for watching the markets on an active daily basis. Further, the return to school and the recent purchase of a home have been beneficial, but have had their own time requirements.

Thus, I will be expanding this blog to reflect my combined efforts to achieve diversified, sustainable alpha, along three different paths:

1. Discretionary trading, when possible, during times of great volatility. My current favorites are monthly unemployment announcements and the Federal Reserve rate decision, for a maximum of 22 occasions every year.

2. Algorithmic trading, picking up a lot of research done in the TradeStation platform. I have migrated a lot of things to NinjaTrader because of the superior tools available, and I am actively learning C# to better utilize the platform. C# fluency also has career implications down the road, and I do plan to take on C++ in short order.

3. Options trading, looking for non-directional spreads with limited delta and gamma risk, looking to sell theta. These types of strategies look best on the final week before expiration, capitalizing on expiring options and the overnight “promotion” of the far-month (long hedging) options to near-month (short premium) options.

I will be explaining my approaches in each of these three endeavors in the posts that follow. As always, thanks for your interest, and I would greatly appreciate your feedback. It is very rare that any individual achieves success in this type of field entirely based on his or her own input.

Leave a comment